[1]New survey shows that 65% of Oregonians dislike tax credit-tax increase swap

[1]New survey shows that 65% of Oregonians dislike tax credit-tax increase swap

By Taxpayer Association of Oregon Foundation,

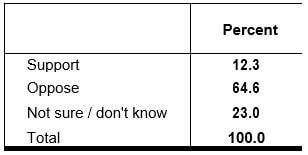

One of the most discussed issues in the Legislature is the complex issue of combining tax increases with renewing tax credits into a single bill with the concept that it evades the 3/5th majority rule pass by voters. Some say this grossly unconstitutional while others say this is perfectly legit. We asked average Oregonians on their opinion of this complex topic. The survey results show that over 60% of Oregonians disapprove of combining tax credits and tax increases into a single bill as a way to avoid the 3/5th majority rule for tax increases. Only 12% support the idea. With nearly a quarter of the public undecided or unsure shows the need for more information on this topic.

Question: Oregon law requires that lawmakers can only pass tax increases if they receive a 60% majority approval to pass. Some wish to bypass this 60% majority rule if a bill raises a tax on one group while lowering taxes for another group. Do you support allowing lawmakers to pass a tax increases with fewer votes if tax increases are linked to renewing offsetting tax credits?

The poll of the tax credit & tax increase combination bill was surveyed of 300 Oregonians.