Oregon House Republicans

“Supporters of SB 324 should be prepared for some hard conversations with constituents”

House Republicans’ Call To Halt Program And Prioritize Transportation Package Garners Support From Across The State

The Albany Democrat-Herald: “The initiative means well, but it never has been clear that it would have more than a symbolic impact on greenhouse gas emissions…The delay could help the way for something that should be a higher priority for the Legislature: Getting the bipartisan support that will be required for a wide-ranging transportation package.” (“House should derail clean-fuels program,” Albany Democrat-Herald [2], 3/2/15)

The Oregonian: “Shaving a tiny slice of Oregon’s emissions will have no discernible effect on the climate, yet the cost to Oregonians will be significant.” (“Will House Democrats find low-carbon courage?: Editorial, The Oregonian [3], 2/25/15)

The Register-Guard: “Republicans oppose SB 324 on grounds that it would lead to higher prices for gasoline and diesel fuel. Some of the estimated increases are scary – up to 19 cents per gallon, according to DEQ. Oregonians would be hurt by price increase of that magnitude…” (“Editorial: Defer clean fuel standard, The Register-Guard [4], 2/22/15)

The Statesman Journal: “…of all the ways to reduce greenhouse emissions in Oregon, is the low-carbon fuel standard the most cost-efficient and effective?” (“Oregon must address reality, not theory, of fuel change,” The Statesman Journal [5], 2/22/2015)

The Albany Democrat-Herald: “In addition, the clean fuels program is exactly the sort of consulting that Kitzhaber’s fiancée, Cylvia Hayes, was tackling…You would think the scandal would give lawmakers ample reason to steer clear, for the time being, of anything that might have Hayes’ fingerprints on it.” (“Editorial: House should kill clean fuels program,” The Albany Democrat-Herald [6], 2/19/2015)

The Oregonian: “Despite the cost and complexity of the fuel standard, removing the 2015 sunset date has continued to be a priority of the environmental left, Kitzhaber and a nonprofit that sent tens of thousands of dollars fiancée Cylvia Hayes’ way…there’s no question that the policy encoded in SB 324 is enveloped thoroughly by the ethical fog generated by Oregon’s outgoing first couple.” (“Peter Courtney’s moment of transportation truth: Editorial,” The Oregonian [7], 2/16/2015)

The Oregonian: “Supported tainted legislation that effected good policy would be bad enough. Supporting tainted legislation that creates bad policy and hinders the pursuit of good policy would be inexplicable. Supporters of SB 324 should be prepared for some hard conversations with constituents.” (“Conflict-tainted bill advances, to Kitzhaber’s tweet relief: Editorial,” The Oregonian [8], 2/5/2015)

The Portland Tribune: “It has become impossible to separate Kitzhaber’s push for reduced-carbon standards from Hayes’ paid work on behalf of advocates of those standards.” (“Our Opinion: Hayes flap clouds Kitzhaber initiatives,” The Portland Tribune [9], 2/5/15)

The Statesman Journal: “If SB 324 is as worthwhile as supporters contend, there is no need to rush it in the Legislature…There will be time for its potential effects to be validated by reputable, independent, disinterested analysts who have no political, ideological or financial interests in the outcome. …legislators should have learned from the Cover Oregon debacle that trying to be a national leader without doing the proper homework and supervision can backfire badly.” (“Slow down, Oregon legislators, on greenhouse-gas bill,” The Statesman Journal [10], 2/4/2015)

The Bulletin: “If this reminds you of the state’s Business Energy Tax Credit program at its worst, it should. You are likely to drive at some disputed additional cost, and that money will, in turn, be given to alternate fuel producers. The cost will fall directly on every car, truck and lawnmower owner in Oregon.” (“Editorial: Let fuel standard law die,” The Bulletin [11], 11/6/2014)

The Oregonian: “…most Oregonians will pay more at the pump in order to subsidize such environmental champions as a utility that provides charging stations for the Tesla crowd…The program is supposed to shield Oregonians from dramatic spikes in fuel prices, but the trigger for scrutiny is 5 percent of the rail price of fuel – about 18 cents for $3.50 gas. And even then, the state is obligated to take immediate and cost-saving action. You can bet it won’t.” (“Buckle up for an Oregon driving-tax blowout: Editorial,” The Oregonian [12], 11/6/2014)

House Republicans Submit Alternative, Cost-Effective Proposal To Reduce Carbon Output In Oregon

Minority Report Legislation Will Utilize Clean Fuels And Repurpose Existing Funds To Research & Development

Salem, OR – In anticipation of this week’s scheduled vote on SB 324 in the Oregon House of Representatives, House Republicans submitted a centrist, alternative plan to reduce carbon output in Oregon without increasing costs for Oregonians or removing any chance for a comprehensive, bipartisan transportation package. The alternative plan, sponsored by Rep. Mark Johnson (R-Hood River) and Rep. Cliff Bentz (R-Ontario) and titled SB 324-MRB (Minority Report B-Engrossed), would address the important issue of carbon output reduction in Oregon by continuing to utilize clean fuels in the state and investing in carbon reduction Research & Development (R&D) initiatives at the state’s flagship universities.

“Senate Bill 324 is a partisan boondoggle that increases fuel prices for Oregon families and businesses while achieving no perceptible outcome in carbon reduction in the state,” said Rep. Johnson, who serves as Co Vice-Chair on the House Committee on Energy and Environment. “This Minority Report submitted by House Republicans offers a common-sense alternative plan that encourages clean fuels in Oregon, repurposes an existing fee for research at our state’s universities, and allows for continuing discussions for a much-needed transportation package that would improve infrastructure and public safety throughout the state.”

Under SB 324-MRB, the state would continue to require the blending of ethanol and gasoline, as well as the blending of biodiesel and other renewable diesel fuel, to meet the standards adopted by the Department of Agriculture, thus maintaining Oregon’s high clean fuels standards without increasing costs for Oregonians through the use of a “hidden gas tax” at the pump. Additionally, SB 324-MRB would repurpose funds collected through utility fee charges for higher education investments at Oregon’s flagship universities – the University of Oregon, Oregon State University and Portland State University – to conduct carbon reduction research.

“Unlike Senate Bill 324, this alternative plan doesn’t funnel billions of dollars to out-of-state companies. It keeps Oregon dollars in Oregon,” said Rep. Bentz, who also serves on the House Committee on Energy and Environment. “If we’re going to make Oregon a leader in carbon reduction research and technology, then we have to start here at home, where our state’s scientists, students and private-sector partners can work together to develop real solutions that reduce CO2 emissions globally.”

Currently, 3 percent of public utility fees paid by Oregon customers are collected into the Energy Trust of Oregon (ETO) for energy conservation projects. SB 324-MRB would repurpose half of the ETO’s annual collections from this fee into funding for the new Carbon Reduction Technology Research and Development Fund, to be administered by the Higher Education Coordinating Commission. Through this new Fund, Oregon universities would receive critical grants and moneys dedicated for the purpose of promoting and advancing research and development of carbon reduction technologies related to transportation fuels. The repurposing of already existing funds also allows for no additional hidden taxes or fees on Oregonians.

“Investing in carbon reduction R&D at our universities and colleges will open up opportunities for private sector partnerships,” said Rep. Johnson. “These kinds of targeted investments will lead to real solutions and make Oregon both a national and global leader in climate-related technology and development.”

House Republicans submitted SB 324-MRB Monday afternoon. They will move to discuss and vote on the amended bill during Wednesday’s House Floor session. A copy of SB 324-MRB is attached to the release.

“It does not repair any roads or bridges in this state. It is a tax hidden from most of the public”

Constituents And Businesses Have Serious Concerns About The Low Carbon Fuel Standard Proposal

Note: These are unaltered excerpts from constituent correspondence related to SB 324

Scott, Welches: “We know with a high level of certainty that if SB 324 passes, the transportation package will be referred to the voters and defeated. In my opinion, this is not a risk we can afford to take. The immediate needs of our state and citizens should be our highest priority, especially when the need is as great as it is in this case.”

Jim, Sheridan: “Most, if any jobs, this bill creates would be out of state jobs.”

Bend Chamber of Commerce: “The LCFS would be especially harmful for our rural community and those who have to drive long distances. Our local citizens and businesses will suffer the most. Senate Bill 324 will reduce the disposable income of the citizens who purchase the products and services that are the lifeblood of the local businesses we represent. The supposed job creation that the LCFS would create is not a real prospect for our community.”

Pendleton Chamber of Commerce: “Pendleton is a tourism ag-dependent rural community. Passage of SB 324 would negatively impact our economy because it would result in higher transportation and operational costs. Many Pendleton businesses already incur higher fuel costs simply by operating in rural Eastern Oregon. Please do not penalize them with low carbon fuel standards that could add expensive equipment retrofits or replacement…We see no positive outcomes for Pendleton businesses or the community as a result of this legislation.”

Shelly, Trucking and Farming Business Owner: “We are strongly opposed to Senate Bill 324 because it will increase the price of fuel that we depend on for our businesses…Our costs have already significantly increased because Hanjin Shipping announcing that it will no longer call of the Port of Portland. We now have to truck our products to Seattle/Tacoma. An increase in our fuel costs will make it far more difficult, if not impossible, for us to compete in what is today a very competitive international market. If we are forced out of business because our costs are not in line with our competitors, nearly 50 Oregonians will be looking elsewhere for jobs.”

Lewis, West Linn: “In the case of non auto use, I see big negatives when then begs the question, is this the most cost effective approach to reduce carbon emissions?”

Jerry & Lynda, HD 59: “…this would be the first time in the history of the state when we would be instituting a fuel tax for something other than bridges and roads, in other words it does not repair any roads or bridges in this state. It is a tax hidden from most of the public.”

Jim, Oregon Cattlemen’s Association: “The increased cost of LCFS will threaten the economic viability and continuity of our family Ranch…Distances of 150 miles are common for the movement of our cattle to pasture, and delivery of our cattle and commodities to the sales destination are commonly in excess of 300 miles. We not only will pay more for our needed supplies, we will receive less value for our product because of the increased freight cost, with the extended distances, directly due from the LCFS being imposed.”

Bill, North Powder: “Oregon has already adopted a renewable fuels standard. We are leading the nation with this policy and have one of the lowest per-capita emissions rates in the country. SB 324 will provide few environmental benefits to Oregonians but will significant impact rural Oregon’s small businesses.”

Angela, Gresham: “I operate a tree nursery in your district and would like to share the impact that SB 324 (The Low Carbon Fuel Standard) will have on my farm. Farming operations likes ours require energy to produce food and fiber. SB 324 is a hidden gas tax that will increase transportation and production costs on my farm!”

Doug, Ontario: “Rural Oregon, and especially border counties, will be devastated by this bill…Malheur County is already the poorest county in the state of Oregon. We struggle to maintain business on this side of the Snake River and Idaho quietly catches all the businesses that decide Oregon is too expensive and restrictive to operate in. the measure will be another nail in the coffin of any chance of creating a recovery for business on the Oregon side of the river.”

Malheur County Cattlemen’s Association: “…the Malheur County Cattlemen’s Association is respectively requesting that you carefully consider this bill & be aware of the large economic harm it will cause to Eastern Oregon producers…10% ethanol has caused a huge financial impact on agriculture already, our small equipment & some trucks can not run on it, and now to add 10% more to the fuel will force great expense on our already burdened industry.”

Wayne, Roseburg: “Rural Oregonian families will be adversely affected by this tax! We need legislators to propose ideas and legislation for job creation, not additional fuel taxation! A hand up, not a further push down.”

Carl, Coquille: “While proponents say the Low Carbon Fuel Standards implemented in SB 324 will not add much to the cost of fuel, there are studies that show it will add $.06 – $1.18 per gallon.”

Rick, Coos Bay: “The reality is the current level of funding both from state and federal sources, is not enough to even keep up with maintaining the status quo of our system. To get to an adequate level of funding is going to require an increase in the gas tax, among other adjustments. This is an immediate need and should be a higher priority than SB 324.”

Terry, Camas Valley: “…there are a lot of us who think that this a foolish way to approach global warming.”

Karin, Brookings: “More study needs to be done to see how the current status fits the intention of the original LCFS…Please don’t allow confusion with Oregon’s historical need to be a front-runner in reforms if they are not worthy and lock Oregonians into commitments we cannot revisit and amend.”

Mike, Lyons: “There isn’t much that I read about coming from the Legislature that helps me sleep at night as an Oregon small business owner…I would be supportive of increasing the gas tax to fund highway infrastructure and the benefits that would accrue from that at many levels. SB 324 increases fuel prices with no highway or economic benefits and marginal environmental gains.”

Tom, Glasdstone: “I am writing to express my objection to the low carbon fuel standard bill, SB 324. I cannot see where it does any good at all. All fuel is hydrocarbon whether it is plant-based or mineral-based so it all contains carbon. The only difference is plant-based fuel costs more and makes my vehicle run worse. All this bill will do is raise costs.”

Wendy, Salem farm owner: “When we purchase new equipment, the tractors, combines, etc. that we purchase have diesel engines in them that reduce emissions. These new style engines have dramatically increased the price of machinery. If a carbon tax is passed that adds to our costs of production, we cannot purchase new equipment as quickly because it is a double cost.”

Gordon, Yamhill farm owner: “SB 324 is a hidden gas tax that will increase transportation and production costs on my farm…I do not support legislation to artificially increase fuel prices or make Oregon businesses less competitive than our neighbors. Please vote NO on SB 324 and protect Oregon’s family farmers from a mandate that we cannot afford.”

Walt, HD 60: “…more ethanol would simply put added pressure on farmers to move toward corn, an irrigation disaster for the air quality…Any greenhouse effect benefits by changing over to ethanol in the fuel stream is more than countered by the crop modification and irrigation effects.”

Yost, Cornelius: “I am concerned that SB 324 would increase fuel prices (or effectively do so due to the lower energy value per gallon), yet not yield substantially reduced carbon emissions (in Oregon). My understanding is that Oregon does not generate much of the total US carbon output…”

Steve, Gold Beach: “I would much rather pay for higher gas taxes than pay for Ethanol fuel, one does nothing for Oregon’s economy and wellbeing, the other helps jobs and infrastructure while reducing hidden costs to citizens and businesses.”

Al, Selma: “LCFS significantly increases fuel prices creating a very expensive cap and trade program that does nothing significant to lower in a real and measurable way, the carbon emissions of fuels. I would much rather see a clean fuels program implemented that encourages and rewards the research and development of clean fuels…”

James, Sublimity: “Please vote NO on the SB324. It will create a hardship on older tax payers on a fixed income…”

Penelope, Pendleton: “…I urge you to further investigate the ramifications of this bill. Its long-range, actual effects are negative to the wellbeing in many areas of your state’s citizens, despite what its proponents are pushing.”

Jeff, Car Dealership President: “For us in Central and Eastern Oregon, often times people to need to commute a substantial distance to get to work…I urge you to vote no, on a poorly written bill lacking scientific backing that will raise the costs to businesses and individuals alike, punishing those that can least afford it.”

Bruce, Central Point: “Consider the current state of the economy – Jackson County, for one, is lagging far behind recovery from the recent economic debacle. Increases in fuel costs of this magnitude will only make it more difficult for the average citizen to make ends meet…”

Richard, HD 54: “Masquerading as climate change policy, this hidden tax scheme has limited environmental benefits yet poses major consequences for Oregonians. We all want to reduce global warming and ensure cleaner air. But punishing everyday motorists, individuals and businesses by increasing fuel costs through hidden taxes is not the way to do it.”

Larry, La Pine: “When gasoline and diesel costs go up, families and small businesses suffer. Poor and middle income families would be hit the hardest, as they typically spend a larger portion of their available income on transportation and fuel.”

Robert, Estacada: “As a rural family that is working in agriculture, we need to work away from our property for supplemental income, as many do, which entails a long commute. This fuel tax, they can call it what they like but that is what it is, will be very hard to absorb for us and others in our situation. Our property and the way we care for it do more to promote a clean environment than the supporters of this bill will ever understand…”

Steven, Powell Butte: “As a long time Oregon resident, I want you to know that I care what happens to our great state’s environment. But this proposed law to further tax our already economically burdened families in the name of carbon reduction is just not right.”

Gail, Roseburg: “I am a small business owner constituent with a business in your district…This is simply a hidden gas tax that will not go to improve roads in Oregon but to supplies of bio-fuel – many of whom are from out-of-state.”

Kyle, Cottage Grove: “What we are already doing is working and will get us to the 2020 standards in SB 324 without a gas tax that will create financial hardship upon small businesses and working families.”

Steve, Grants Pass: “As an Oregonian who relies on a car for work and family obligations, I’m concerned not only about the impact on my own pocketbook but also about others in the state. When gasoline and diesel costs go up, families and small businesses suffer. Poor and middle income families would be hit the hardest, as they typically spend a larger portion of their available income on transportation and fuel.”

K., Cave Junction: “There is talk about a possible gas tax, which would make it very difficult for any lower income person, especially us retirees, to drive from our rural areas to Grants Pass…Even driving from rural Illinois Valley to Cave Junction strains my low income retiree’s budget.”

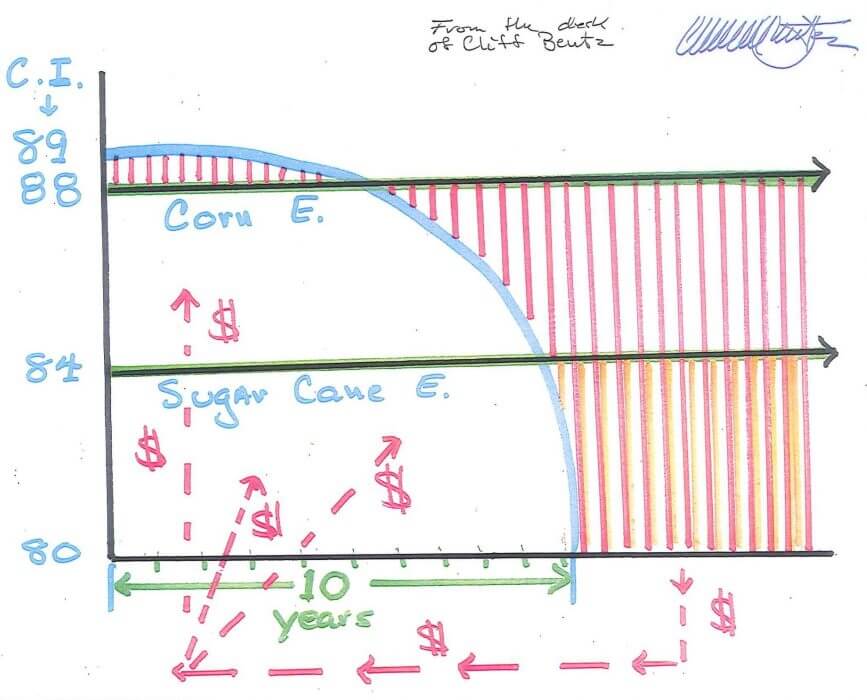

Rep. Cliff Bentz Debunks SB 324 Using One Simple Chart

Salem, OR – During today’s House Floor discussion and vote, Representative Cliff Bentz (R-Ontario) presented a chart to highlight the negative impacts of SB 324 on fuel prices.

Click here [14] for a PDF of this chart.

Below are highlights from Rep. Bentz’s presentation:

- Starting point of 88 carbon intensity, where corn ethanol rests.

- Starting point of 84 carbon intensity, where sugar cane ethanol.

- Target for Oregon under SB 324 is 80 carbon intensity.

- Red and yellow lines show deficit, the point where you’re still selling corn and sugar cane ethanol. But as the amount you blend increases, you have to find credits.

- The actual impact of SB 324 is pushed out (blue line) through 4-5 years. The consequences of today’s vote are delayed but will be felt across the state.

- As the carbon intensity drops, you will have to pay more and more as prices increase.

- This program doesn’t save people money, it costs you money. This is a stealth tax.

- How much is it going to cost? According to DEQ, 19 cents, which is a half-billion dollars more a year for consumers.

- If this program works, there’s a 10 percent reduction of 1.2 million metric tons of carbon in Oregon.

- Decreasing carbon in Oregon by 1.2 million metric tons will cost Oregonians a half-billion dollars.

- The ends do not justify the means.

Rep. Julie Parrish on SB 324: Our Food Supply And Our Fuel Supply Cannot Compete

Salem, OR – During today’s House Floor discussion and vote, Representative Julie Parrish (R-West Linn/Tualatin) spoke about the negative consequences of SB 324 on Oregon’s low-income and working families who will be subject to higher food prices as transportation and agricultural costs increase. SB 324 does nothing to lift Oregonians out of poverty or reduce costs for families.

Below are highlights from Rep. Parrish’s remarks:

- In July 2010, Oregon had almost 718,000 Oregonians on food stamps.

- In January 2015, that number, while reduced, sits uncomfortably at over 775,000 Oregonians.

- As stated by Senator Diane Feinstein, a Democratic Senator from California – another state trying to navigate a Low Carbon Fuel Standard path – “A significant amount of U.S. corn is currently used for fuel. If the mandate continues to expand toward full implementation, the price of corn will increase. According to the Congressional Budget Office, that would mean as much as $3.5 billion each year in increased food costs. Americans living on the margins simply can’t afford that.”

- Senator Pat Toomey, a Republican Senator from Pennsylvania, echoed Senator Feinstein’s statement in his own recent comments on fuel standards: “The Renewable Fuel Standard requires fuel supplies to blend millions of gallons of biofuels – most often corn ethanol – into the nation’s gasoline supplies. It drives up gas prices, increases food costs, damages car engines, and is harmful to the environment.”

- These two very ideologically and geographically diverse U.S. Senators have both come to the conclusion about unproven fuel standards and their impacts on families across the nation.

- The bottom line, and what our Congressional counterparts have realized is something extremely critical for the people we represent, particularly those at the bottom end of the income scale: OUR FOOD SUPPLY AND OUR FUEL SUPPLY CANNOT COMPETE.

- Prices of goods & services in Oregon has gone up, but what hasn’t gone up is the income of Oregonians. And the SNAP program isn’t tracking appropriately for inflation, let alone runaway growth in food costs.

- The diminished buying capacity of consumers in our communities means that when food prices go up due to transportation and agricultural costs, the consumer is forced to make real decisions about what type of food choices they can afford to make.

- Food and fuel in a symbiotic relationship is a win for grocery consumers. It keeps prices low and makes it easy for consumers to make new food choices like organic, non-GMO, or fair trade products.

- In order to sustain bio-fuel production at the levels it would take to implement these standards, the Low Carbon Fuel Standards will require high-intensity farming that relies almost singularly on GMO inputs.

- SB 324 will force some very difficult conversations in the near future, both inside and outside of this building, about the rights of a consumer to access foods that are not conventionally produced at a sustainable price.

- Additionally, I do not believe that Oregon has the managerial capacity nor the skills required to implement large-scale programs and deliver them to Oregon taxpayers in a timely or cost effective manner.

- Hundreds of millions of taxpayer dollars have been lost on things state government never delivered on: Cover Oregon, the CRC, BETC tax credits, numerous agency software projects and the state radio project.

- I liken the Low Carbon Fuel Standards to the execution of the BETC credits – which by all accounts, have been a spectacular failure filled with boondoggles and scams.

- Unlike the hugely expensive mess created by Cover Oregon, this time, on this bill, outside of the purview of the public, there is no shut off valve.

- We’ve seen failure after failure in green energy projects, with little accountability to the taxpayer for the heavy losses we’ve incurred.

- If Oregon is going to be a bold visionary on green energy, then SB 324 is the wrong vehicle to attract truly cutting edge companies and sign them on the dotted line to become Oregon companies.

Click here [15] for a document that charts the number of SNAP recipients since July 2010.

Pain At The Pump: How Much Will SB 324 Cost Oregonians? [16]

Rep. Mark Johnson On SB 324: What Happens When The Clean Fuels Don’t Meet Carbon Emissions Standards?

Salem, OR – During today’s House Floor discussion and vote, Representative Mark Johnson (R-Hood River) asked the questions Oregonians have about clean fuels in Oregon: Where do these clean fuels come from? What percentage of them are being produced in Oregon? What happens when the fuels don’t meet carbon emissions standards?

Below are highlights from Rep. Johnson’s remarks:

- The Low Carbon Fuel Standard bill proposed in 2009 was reactionary. There have been some major changes over the last 6 years.

- The world’s experiences and attitudes about biofuels to supplement traditional products have changed dramatically as well.

- If you use land for one purpose, you can’t use it for another.

- The civilized world is moving away from biofuels to meet demands.

- Where will we turn when we can’t meet DEQ’s standards for blending?

- We begin to encounter real folks who are running into real problems as food continues to be used to meet these clean fuels demands.

- This is about a global issue.

- Turning food into fuels is yesterday’s idea.

- Consumers want to do the most efficient thing and do what’s good for the state and planet.

- Oregonians are lowering their carbon footprint every day, not because they have to, but because they are good people and want to make their own decisions.

Rep. Johnson sponsored the House Republican Minority Report, SB 324-MRB [18], which failed today in the House on a party-line vote. The Minority Report would’ve continued to utilize clean fuels in the state while also investing in carbon reduction Research & Development initiatives at the state’s flagship universities.

Rep. John Davis on SB 324: Costs With No Impact

Salem, OR – During today’s House Floor discussion and vote, Representative John Davis (R-Wilsonville) read emails from constituents concerning the increase in costs to Oregonians without seeing meaningful results from the program.

Below are highlights from Rep. Davis’ remarks:

- DEQ, our own agency, is predicting a cost for consumers – our own constituents.

- The program will have no meaningful effect on the cleanliness of our air.

- DEQ has had years to implement this program and it has not worked or been fully implemented.

- Promises to present land use projections from DEQ have never been fulfilled.

- The cost to our constituents won’t go to improve our roads or infrastructure. It will go to private companies.

- We have continually been told that SB 324 is a simple lifting of the sunset of the program. Not true.

- The bill is many pages of changes to the LCFS, a lifting of the sunset indefinitely, and then deferring the authority to DEQ to make changes to the program without conferring with the Legislature.

- The costs to your constituents and to Oregonians range from 4 cents to more than $1 a gallon.

- The very minimum, 4 cents, is $100 million a year – costs to Oregonians that won’t be going to our roads and bridges.

- Let’s adopt a meaningful strategy to reduce carbon output without increasing costs for Oregonians.

- Thoughts from actual constituents:

- Most people are recovering from a recession. Some people can barely afford to pay their bills.

- Gas prices are up, utility bills are up, costs of services and products are up.

- Tired of paying premiums for negligible results and impacts.

Rep. Knute Buehler on SB 324: The Costs Of This Bill Are Local, Real And Immediate

Salem, OR – During today’s House Floor discussion and vote, Representative Knute Buehler (R-Bend) raised concerns about what safeguards are currently in place to prevent the market on credits from spinning out of control and driving up costs in the long run for other producers and sellers.

Below are highlights from Rep. Buehler’s remarks:

- Global climate change surely is real. The nation and Oregon need effective and smart plans to combat climate change.

- Raising these carbon standards in our state is neither smart nor effective.

- Rather than forcing Oregonians to pay higher fuel prices, Oregon should do its part by investing in university research in cleaner fuels and by investing in transformative transportation methods.

- The costs of this bill are local, real and immediate. And the benefits are uncertain, long-term and go to those outside of Oregon.

- Promises of another risky, taxpayer-financed energy jobs scheme have zero credibility.

Rep. Carl Wilson on SB 324: This Is One Of Those Bills Where You Have To Pass It To Know What It Does

Salem, OR – During today’s House Floor discussion and vote, Representative Carl Wilson (R-Grants Pass) called on his colleagues to consider costs to rural Oregonians, many of whom live in areas struggling to recover from the recent recession. He also called on the Legislature to restore public trust in the legislative process.

Below are highlights from Rep. Wilson’s remarks:

- Letter from constituent: LCFS will threaten the economic viability of our farm and affect our ability to keep costs down when driving long distances and purchasing new equipment.

- This bill, like many around here, accentuates the urban-rural divide and, once again, rural Oregon gets an elbow to the side of the head.

- Oregonians know that the LCFS will drive up their fuel costs and media outlet after media outlet has warned the public about that.

- This is one of those bills where you have to pass it to know what it does.

- When the heart of SB 324 became the subject of a federal investigation, even mentioned by name in a federal subpoena, it seemed the perfect time to send this bill away.

- Today, we have the opportunity to keep honor in the legislative process.

- Colleagues, it does matter what this process looks like as we do the business of the people. News headlines all over Oregon have fulfilled their obligations to their readers, viewers and listeners, trying to flag down this body on this issue. This is Oregon, not Illinois.

- This is a golden opportunity to restore public trust in this building.

Rep. Dallas Heard On SB 324: This Program Will Make It That Much Harder For The Next Generation

Salem, OR – During today’s House Floor discussion and vote, Representative Dallas Heard (R-Roseburg) challenged his colleagues to consider SB 324’s economic costs to the next generation while they work to establish themselves and build their own businesses.

Below are highlights from Rep. Heard’s remarks:

- I am speaking from the heart today, from my experience as a young father and as a business owner.

- As a parent, there is nothing that will get in my way of taking care of my son. And consequently, your children and grandchildren because they are all part of the same generation.

- Speaking as a business owner: when fuel prices go up, shipping prices go up.

- It was very difficult for me to compete with the market competition because I ran such a small farm.

- This program will certainly impact those of us who struggle the most.

- I worry that my son will have an even harder time than I did.

- This program will make it that much harder for the next generation to establish themselves.

- I want clean air, but we have to be able to afford the transition into that kind of economy.

- Please think: how is this going to affect all of Oregon?